The Help to Buy equity loan scheme was first introduced in April 2013, to provide government loans of up to 20% of the cost of new properties under £600,000. In February 2016 it was extended to provide loans of up to 40% of the cost of new properties in London. Since its inception, the scheme has helped over 120,000 buyers to purchase a new property, which has undoubtedly provided a boost to the new build sector.

Recent reports in the press have suggested that the government has asked the London School of Economics (LSE) to review the scheme and rumours abound that the scheme may be ended early. The DCLG have since released a statement confirming their continued commitment to the scheme until 2021.

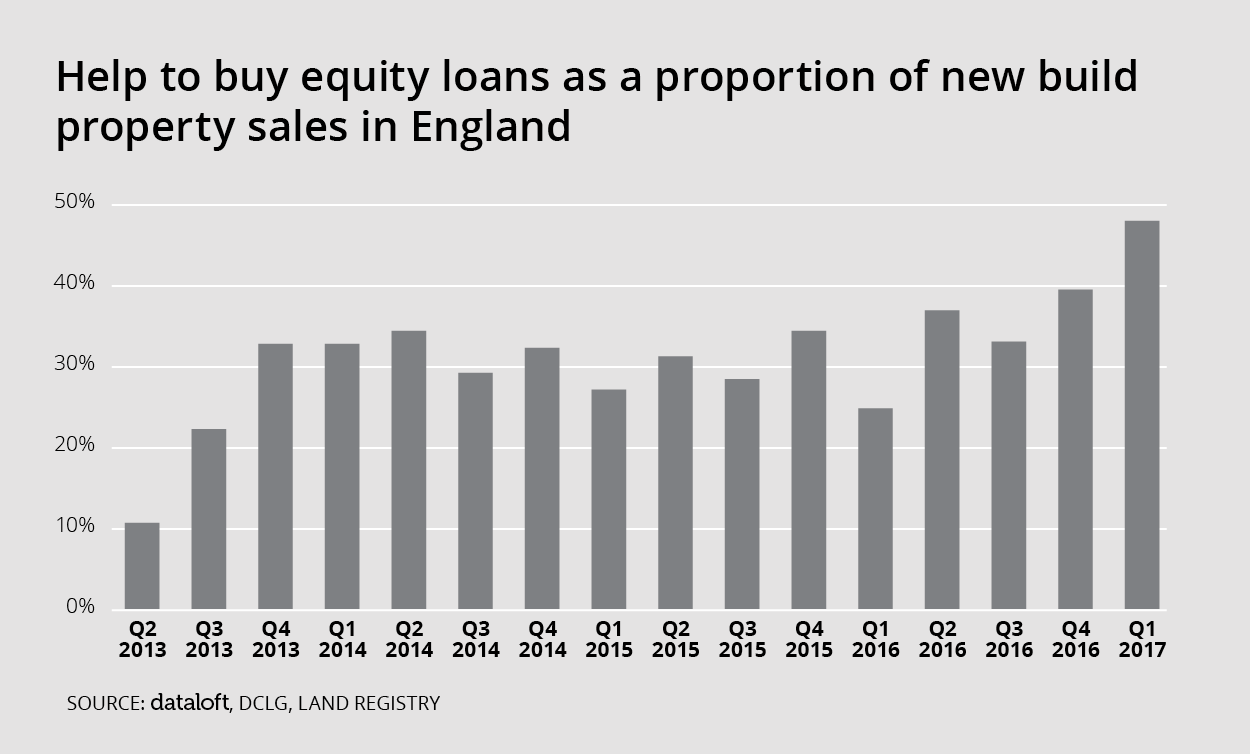

The proportion of new build properties bought with the use of a Help to Buy equity loan has been steadily rising. We estimate that in the first quarter of 2017, just under half (48%) of all new build properties were bought with the assistance of Help to Buy.

This will come as a welcome relief to new build developers who have become increasingly reliant on the scheme, although there is still the possibility that the price threshold might be reduced.