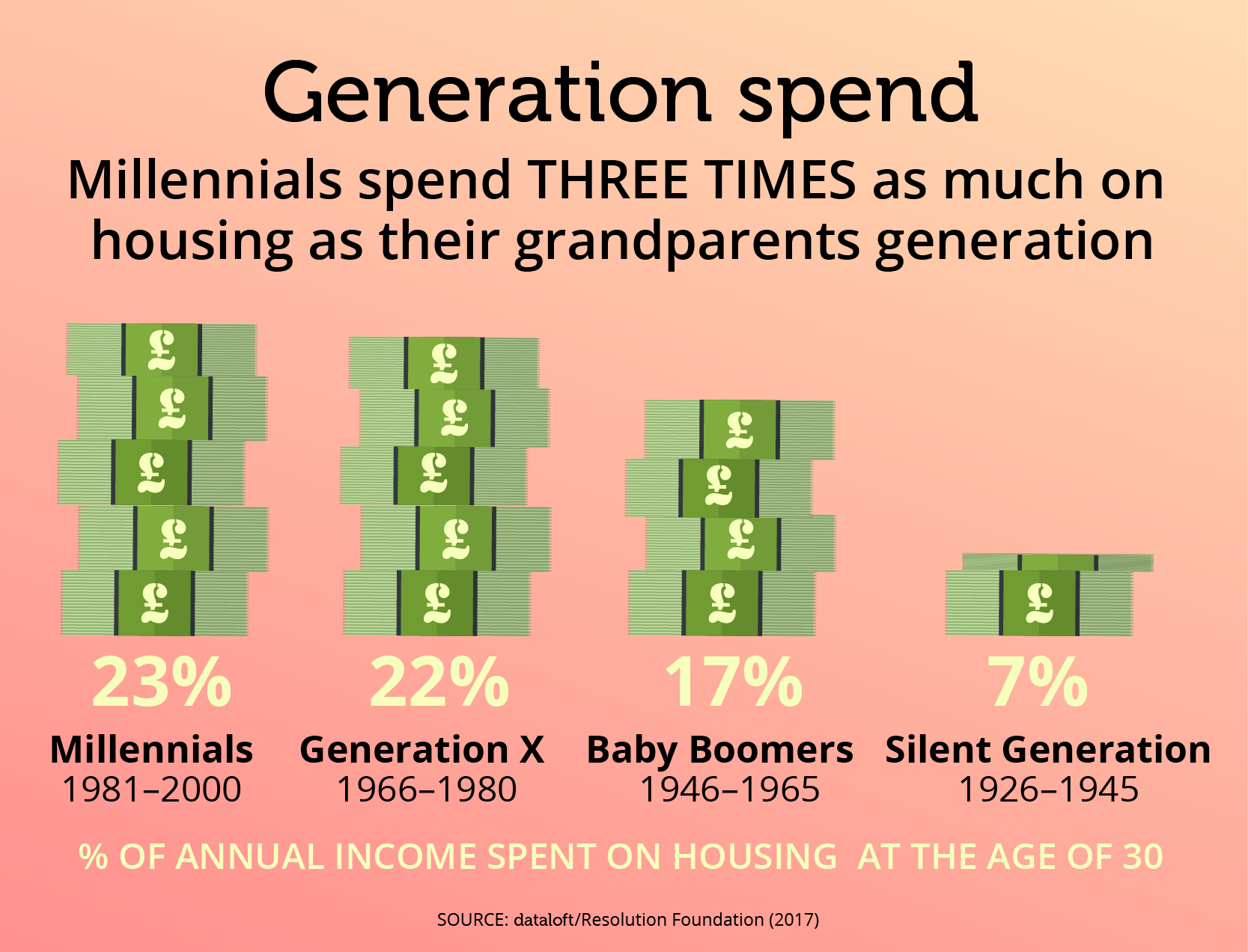

Research by the Resolution Foundation think tank has found that young people are spending three times more on housing than their grandparents did.

The post war baby boomers now benefit from record levels of outright ownership, but there are now as many young families (aged 25–34) living in the private rented sector as owning a home or living in the social rented sector combined (36%).

At the age of 30 millennials spend 23% of their annual income on housing costs, compared to those born 1926–1945 who, aged 30, spent just 7%.

While the number of mortgage loans issued to first-time buyers over the past year is at its highest level since pre the financial crisis, the average age of a first time buyer looks set to continue to rise over the coming years.